How to Measure an SPV's Performance

An SPV is a fund that invests in a single asset. It’s financially equivalent to buying that asset, minus the setup fee paid to the fund administrator and the performance fee paid to the SPV leader. The vast majority of employee led SPVs that invest in VC backed startups accept capital once and then distribute any returns when the company exits.

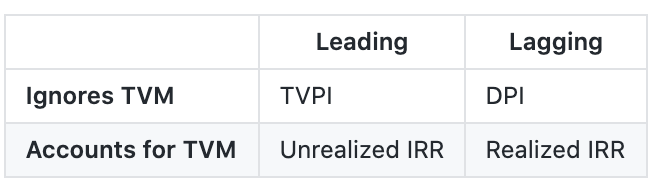

We use four metrics to measure the performance of an SPV. Each metric tells us something different and we need all four to get the full picture.

*TVM = Time Value of Money

PI

Paid-in capital. The total amount of money investors have sent to the SPV (including admin fees).

DPI

Distributions to Paid-In Capital. The total amount of money the SPV has returned to investors (Distributions) divided by Paid in Capital.

TVPI

Total Value (Residual Value + Distributions) divided by Paid-In Capital

In most SPVs, Distributions are usually 0 until the SPV is dissolved. A single distribution then happens and then Residual Value becomes zero.

TVPI can be either gross or net of fees. TVPI is usually calculated net of fees.

IRR (Internal Rate of Return)

Realized

Realized IRR is DPI but accounting for the Time Value of Money. For example, a DPI of 2 is great for a 2 year investment (~41%) but not so great for a 10 year investment (~7%).

Unrealized

Unrealized IRR is TVPI but accounting for the Time Value of Money. SPVs usually only have one cash inflow at formation and then one cash outflow at dissolution. Sometimes an SPV may sell shares in between formation and dissolution. This would affect IRR but is rare enough that I won’t cover that case here.

This guide is a excellent deep dive into these metrics with example calculations. I have very little to add to it.